SIUL: A Multi-Generational Asset for Family Legacy Planning

When planning for the future, families often look for ways to provide protection and income across generations. Survivorship Indexed Universal Life (SIUL) insurance is a vehicle designed not just for couples, but also for parent-child duos aiming to maximize legacy planning. This blog explores how SIUL can serve as a powerful multi-generational solution.

The Concept of SIUL in Legacy Planning

Traditionally, SIUL policies are associated with spouses, using the concept of blended mortality to enhance the benefits passed on to heirs. However, this strategy can also extend to a parent and an adult child, creating opportunities for wealth transfer and access to living benefits.

Illustrating SIUL's Multi-Generational Advantage

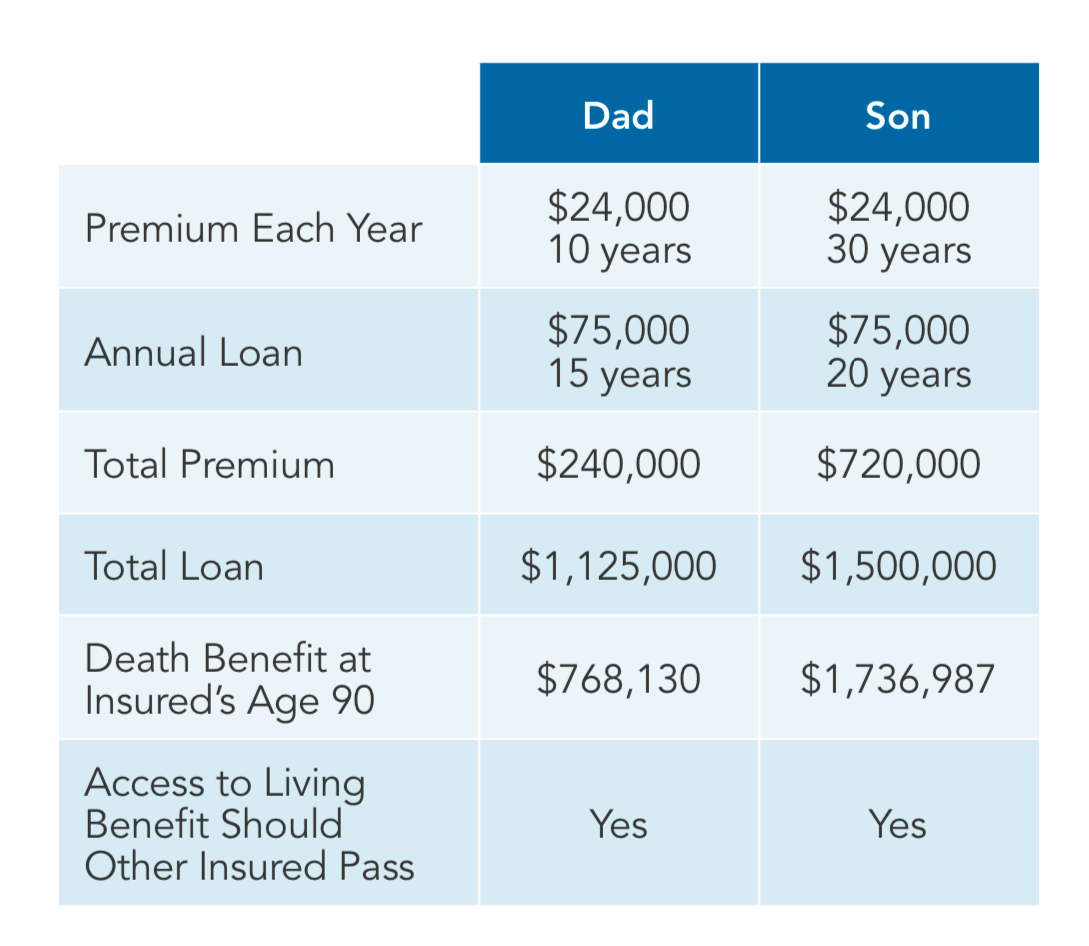

Take the example of Dave and his son Steve. Dave initiates the SIUL policy, contributing a fixed premium for a decade, with Steve continuing the payments thereafter. This long-term funding approach allows for significant cash value growth, which Dave can utilize through participating loans while he's alive. After his passing, Steve then gains access to the policy's living benefits and continues to grow its value.

A Real-Life Scenario

Imagine Dave contributing $2,000 monthly for ten years, amassing a total of $240,000 in premium payments. At age 75, Dave could start receiving $75,000 annually through participating loans, enjoying this income until age 90. After Dave, Steve can continue leveraging the policy's value in a similar manner, securing an income stream for himself and ultimately leaving a substantial death benefit for his children.

The Long-Term Benefits

Such a strategic use of SIUL allows both Dave and Steve to benefit from the policy's cash value during their lifetimes, all while ensuring a sizeable legacy for Steve's children. It showcases how tax-free growth, death benefit protection, and flexible cash value accumulation can work together to protect multiple generations.

Flexible Premium Survivorship Adjustable Life Insurance Policy with Indexed-Linked Interest Options Policy Series ICC19 CL92 1908 issued by Columbus Life Insurance Company.