Life Insurance in Retirement Planning (LIRP) | Another Roth Alternative

High-income earners face challenges in finding retirement savings options that minimize their tax burden. While Roth IRAs provide tax advantages, the income limitations and contribution limits often exclude high earners from directly contributing. However, there are strategies to work around these limitations. The backdoor Roth IRA strategy allows high-income individuals to make indirect contributions and enjoy the benefits of Roth IRAs. Additionally, the mega backdoor Roth strategy enables certain individuals to transfer specific types of 401(k) contributions into a Roth account, overcoming income and contribution limits. These strategies offer opportunities for high earners to optimize their retirement savings and minimize taxes.

But what to do if those backdoor Roth strategies aren’t available or are not enough?

Another strategy for Tax Diversification is a LIRP. Life Insurance in Retirement Planning (LIRP) is an effective strategy that incorporates a life insurance policy into retirement planning, providing numerous benefits for individuals seeking growth potential and protection. By funding a life insurance policy at a specific level while adhering to modified endowment contract (MEC) rules, one can build substantial cash value and enjoy tax-advantaged withdrawals during retirement.

Tax diversification is a key driver behind LIRP. Just as asset diversification is important, managing client risk through tax diversification is equally vital. One typically possess various types of assets, categorized by asset class and tax status. Tax-deferred qualified accounts like IRAs and QRPs fall under the "tax-me-later" investments category. These are accompanied by "tax-me-now" assets such as stocks, bonds, and real estate that generate taxable income. However, often overlooked are the "tax-me-never" investments like Roth IRAs, municipal bonds, and life insurance policies.

Life insurance plays a crucial role in protecting families financially during their working years, providing a death benefit upon the untimely demise of the primary breadwinner. In retirement, life insurance can offer potential tax-free distributions, further enhancing its appeal.

One popular type of life insurance policy utilized in LIRP is indexed universal life (IUL), which combines the flexibility of traditional universal life insurance with a death benefit. IUL policies have the potential for significant cash value accumulation, especially during favorable market conditions, while providing downside protection during market downturns through a minimum guaranteed interest rate. Depending on funding levels, market conditions, and the tax environment, an IUL policy can offer tax-free supplemental retirement cash flow, improve asset diversification, and enhance tax diversification, satisfying the needs of today's consumers who seek flexibility.

To achieve optimal supplemental retirement cash flow with an IUL policy, it requires a shift in conventional thinking. While most clients aim for the highest death benefit at the lowest premium, this approach results in increased net amount at risk and higher cost of insurance (COI) with universal and variable life insurance policies, reducing the available cash value for tax-deferred growth. By controlling and minimizing the COI, more premium can be allocated towards cash value accumulation.

When one need to access cash in their policies during retirement, they can withdraw their basis in the IUL policy tax-free. Withdrawals from non-MEC life insurance policies are taxed on a "first-in, first-out" (FIFO) basis, known as the "cost recovery rule." This means that withdrawals are included in gross income only if they exceed the client's basis or investment in the policy, after considering any prior excludable distributions. Once the basis has been withdrawn, clients can take a loan from the policy's cash value, which is not taxable as it is considered a policy loan rather than a distribution.

It is important to note that loans and withdrawals may generate an income tax liability, reduce the account value and death benefit, and could cause the policy to lapse if not managed properly. Adequate premium payments and account value are essential to cover insurance costs and prevent policy lapse. Policies typically offer an Overloan Protection Rider to help avoid this situation.

It's worth emphasizing that the effectiveness of the LIRP strategy can vary based on funding levels. A maximally funded policy is likely to yield more favorable results, while reduced funding may negatively impact the potential benefits. One must carefully evaluate their ability to commit to significant premium payments for several years and avoid taking distributions for an extended period to allow for tax-deferred growth.

Frequently Asked Questions (FAQs):

1. Are there any disadvantages to using the LIRP strategy?

While an IUL policy allows premium flexibility, a successful LIRP strategy requires clients to commit to significant premium payments for several years and delay taking distributions to allow for tax-deferred growth. Surrender charges may apply in the early years, and if a life insurance policy with an outstanding loan balance lapses, the amount of the loan balance will be included as income to the extent of any gain in the contract.

2. Are the premiums deductible?

Generally, premiums paid for life insurance are not deductible. However, a properly designed policy can accumulate cash value tax-deferred, provide income tax-advantaged distributions, and offer tax-free death benefits.

Common Scenario

A High Income earner has maxed out contributions to their qualified retirement account(s). The bulk of their investable assets may be in their qualified plan and/or IRA.

They would like to explore additional means of nonqualified savings, are concerned about the risk that tax laws could change, and that their expected post- retirement tax rate may be higher than anticipated. They may benefit from life insurance protection to help cover their family’s financial needs in the event of their passing.

Who May Benefit

• Age: 35–60

• Maxing out contributions to qualified retirement

plan(s), additional money to allocate towards savings

• Concerned about sufficiency of retirement income; if taxes increase, it could have a negative effect on retirement income

• Is insurable and has a life insurance need

Benefits

• Immediate death benefit protection

• Policy cash values accumulate tax-deferred

• Cash values may be accessed on a potentially income tax- free basis during the client’s lifetime

• No Internal Revenue Code contribution limits

(policy design and insurability will dictate any limitation)

• No Required Minimum Distributions

• No pre-591⁄2 early withdrawal penalties

Disclosures

It is crucial to consult with a qualified financial professional to assess individual circumstances, financial goals, and risk tolerance before implementing a Life Insurance in Retirement Planning strategy.

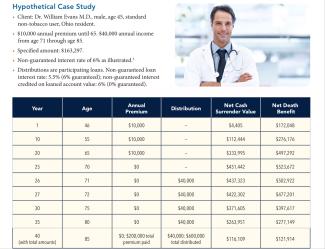

Hypothetical example showing values based on 45-year old male in OH, Standard non tobacco, $163,297 face amount with a $10,000 annual premium. Values based on a 6% non-

guaranteed illustrated rate, which is subject to change and an Option 2 increasing death benefit until age 65 and then Option 1 level death benefit until age 120. As of 12/16/21. Included for illustrative purposes only.

Maximum illustrated non-guaranteed rate is 6.45%

IUL is a universal life policy. It has insurance related costs. Premiums paid must produce sufficient cash value to pay insurance charges. Indexed returns do not protect against lapse if premiums and returns do not provide sufficient cash value to cover loan interest and insurance costs. Prospective clients must understand that loan risk means loans may well not be zero cost. Such loan risk and interest costs will reduce account value and will contribute to a risk of policy lapse if account value becomes insufficient to cover charges. Loans will accrue interest.

Index returns do not guarantee that the policy will stay in force.

The Product in the hypothetical example above is issued by Columbus Life Insurance Company, Cincinnati, Ohio. Indexed Explorer Plus Flexible Premium Universal Life Policy. Benefits vary by state. Check the approved state variation. Flexible Premium Adjustable Life Policy with Indexed Options ICC17 CL 88 1708. Features and benefits are subject to underwriting and issue age restriction. Availability of policies, riders, definitions and benefits varies by state. Check the approved state variation. Payment of benefits under the life insurance policy is the obligation of, and is guaranteed by Columbus Life. Guarantees are based on the claims- paying ability of Columbus Life.

The information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice.

Consult an attorney or tax professional regarding your specific situation.